Summary: IT sector is hiring at a war footing – with everything possible going online, the demand for IT professionals for developing and supporting the same has grown manyfold. This, means that the organisations have to really up their game at hiring talent, or be left out.

The Indian IT sector can be divided into 3 broad categories –

- IT services, which has firms like Infosys, TCS, IBM, etc.

- Dedicated developmentcenters of International firms like JP Morgan, VMWare, Walmart, etc and Indian units of large International Product firms, like Google, Microsoft, Adobe, etc

- Indian Startups like Flipkart, Caratlane, or product firms like Freshdesk.

Together, the IT sector employed approximately 4.36 million people in India in 2020, and was adding around 1.2 to 1.5 lacs per year since 2015

Now let us look at what is happening in these sectors, one by one

IT services – Scenario today

The IT services sector is by far the largest of the 3, employing roughly around 75% of the total headcount, roughly 3 million people, as of 2020.

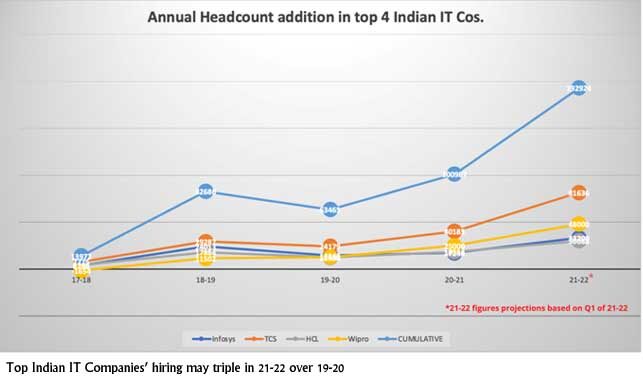

To understand what is happening there, we recently looked at the data from the top 4 Indian IT companies – Infosys, TCS, Wipro, HCL. What we realized, that in Q1 21-22, their rate of hiring is already almost 2.5 times from 2018-19. If they continue at the same rate, we will see them adding nearly 2 lac employees this year.

Similarly, one of our clients, one of the largest IT consulting companies, mentioned he is looking at a total headcount addition of 84000 in coming 12 months!

Anecdotal data is showing similar trends in Accenture, Cap Gemini, IBM,etc as well as mid sized firms like Zensar, Persistent, etc)

If all this holds true, we may see IT Services add over 4 lac employees in 21-22, compared to just 1.38 lacs for the whole of IT sector last year!

Tech Centers/Captives

India, as per news reports, had over 1600 captives units as of 2020 which were employing around 1.3 million or just about 30% of the IT sector.

2021 has already seen the announcement of many Captives being setup in India.Microsoft recently opened a new center in Noida. Economic times had reported in June that over 100 new captives are expected to come up in 2021 alone.

Not just that, the existing ones are actively scaling up. One of our large captive clients, has told us they will almost double their headcount from 2300 right now to 4000+ by Dec 2022! Another one has given is an RPO to add 120 to their current 180 by March 2022. Again, we hear similar stories from others in the industry.

The restrictions on H1B visas has also meant companies are getting more work done off shore.

What all this means is that we can expect this sector too to add many times more jobs than it has been over the last few years.

The Startup Bull run

At the time of writing this article, India has already added 23 unicorns to its existing list of 28 at end of 2020, to take the total as of 2021. And, we have already seen a deluge of new funding for Indian startups – over 21 billion USD till end of August, vs 11 billion for the whole of 2020!

Not just that, it is now an established trend in Bay area Startups to offshore the development to India as soon as they get their first funding cheque in.

While there are no credible estimates of total IT people employed in the start up space, Govt data says around 1.75 lacs were employed as of Feb 2021. We can assume it to at least double from here, looking at all the funding coming in.

Digitalization, the new baby

Companies are building their digital capabilities at a rapid pace because they know whatever can be delivered digitally, has too be delivered digitally.

Even traditional, old economy companies are seeing large scale Digitalisation, and across sectors – whether it is Pharma, Manufacturing or FMCG, the trend is everywhere.

One of our clients, a large food/FMCG company, added over 200 techies in last 1 year, and plans to add 500 more in next 18 months! Another, a PSU, is adding 20 IT employees every month, where they barely had 20 overall last year!

India has over 1.25 million registered companies. While the impact per company may be small, if all traditional companies have to add even a few dozen techies to their payroll, the cumulative hiring shock will be just too large to absorb!

What it all means –

If we extrapolate this, we are looking at a minimum of 6-7 lacs new hirings in IT this year. That is simply unprecedented. We barely have 1 lac fresh Computer Engineering/similar graduates entering the employment market every year. How do we get the rest?

What this means that the demand is many, many times of supply. That is why we are seeing unprecedented 100% hikes and nonstop offer shopping.The organisations have to be ready to meet the ever evolving market scenarios and candidate expectations to be able to get the talent they need.

And, the winner for this war for talent may actually be the Talent itself.

Future trends – (optional section)

Right now, 3-6 years is the hot in demand segment, but going forward 0 to 3 will be where the battle is. Campus hiring will be critical. Smarter orgs will go to Kota and start training 12th pass students on skills needed and offer them ASAP, even if on a part time/ gig basis. Similarly reskilling will up in a big way and those who can learn a digital skill, will be lapped up by the

Not just that, this will push Automation and capital will flow to replace labour. No Code will gain traction faster, and the Strategy & Design will be the most in demand.

Highlights:

Digital / Cloud were a vertical, now they are a horizontal.

With Metaverse, every organization has to get its digital chops or be left out on the way.

Crypto/Blockchain will be the new Gold Rush

Leave a Reply